Finance: Page 3

-

Q&A

Why a former ESG skeptic is teaching fiduciaries impact investing at MIT

“Not all impact investments are created equal,” said Andrew Lo, a MIT Sloan School of Management professor. “One needs to focus very specifically on what kind of impact they'd like to achieve.”

By Lamar Johnson • May 15, 2025 -

Financing gaps for biodiversity conservation persist as corporations look to nature-based solutions

While more corporations have invested in conservation and nature-based carbon credits, experts at DC Climate Week said there are hurdles to closing the funding gap.

By Lamar Johnson • May 14, 2025 -

Explore the Trendline➔

Explore the Trendline➔

TarikVision via Getty Images

TarikVision via Getty Images Trendline

TrendlineTop 5 stories from ESG Dive

This year has shaped up to be a formative one for ESG, from the U.S. pulling out of major climate agreements to federal agencies recalibrating their approach to sustainability under the new administration.

By ESG Dive staff -

House GOP proposes early phaseout of IRA clean energy tax credits

The House Ways and Means Committee’s draft budget scales back the technology-neutral clean energy investment and production tax credits while leaving carbon capture credits largely intact.

By Brian Martucci • May 13, 2025 -

Google announces deals for nuclear projects, cutting superpollutants

The deals with Elementl Power, Recoolit and Cool Effect will provide early stage financing for three nuclear energy projects and eliminate 25,000 tons of superpollutants from the atmosphere.

By Lamar Johnson • May 12, 2025 -

Microsoft, EFM ink forestry-based carbon removal deal

The carbon offtake deal with the forest investment and management firm will provide the tech giant 700,000 nature-based credits through 2035.

By Zoya Mirza • May 12, 2025 -

NOAA stops tracking cost of extreme weather and climate disasters

The data can't be replicated by city and state governments, scientists say.

By Robyn Griggs Lawrence • May 12, 2025 -

DC’s first climate week highlights net-zero innovations and challenges

More than 4,500 attendees were in the nation’s capital as climate experts and startups look to make Washington, D.C. one of the top climate tech hubs in the U.S.

By Lamar Johnson • Updated June 2, 2025 -

Central bank climate coalition releases near-term scenario planning tool

The Network of Central Banks and Supervisors for Greening the Financial System released the first public tool to examine the short-term impacts of climate change and related policies on the economy.

By Lamar Johnson • May 8, 2025 -

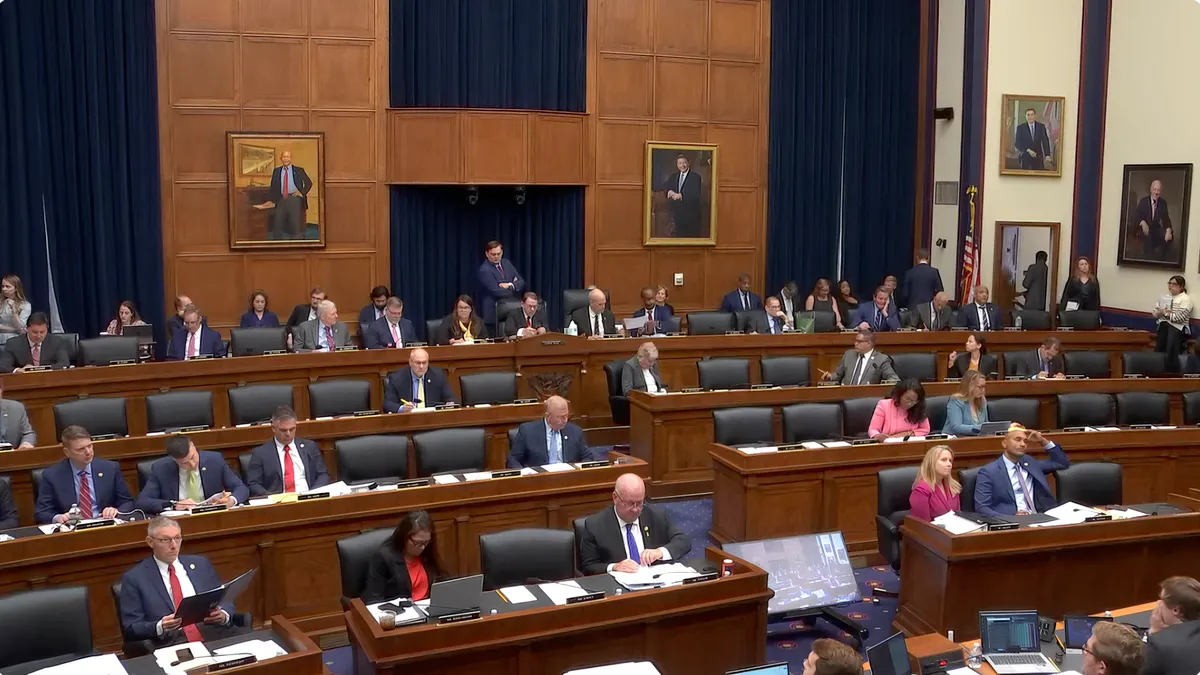

(2025). "https://www.youtube.com/live/XhheK2197-8?si=FLXzFrXpEFreLvHx" [Video]. Retrieved from T&I Committee Republicans/YouTube.

(2025). "https://www.youtube.com/live/XhheK2197-8?si=FLXzFrXpEFreLvHx" [Video]. Retrieved from T&I Committee Republicans/YouTube.

House committee proposes annual $250 fee for EVs

Shoring up the Highway Trust Fund with annual federal registration fees for electric and hybrid vehicles is part of the Transportation & Infrastructure Committee’s budget reconciliation proposal.

By Dan Zukowski • May 7, 2025 -

HSBC pressed on net-zero by $1.6 trillion investor group at annual meeting

Some 30 investors called on the bank to “urgently affirm” its commitment to its climate goals and prioritizing net-zero emissions across its operations.

By Zoya Mirza • May 5, 2025 -

Retrieved from Wikimedia Commons.

Retrieved from Wikimedia Commons.

US solar, battery manufacturing to expand through 2027 despite uncertainty: Anza Renewables

This year, Anza sees tighter supplies and higher prices for U.S.-made solar cells and battery components as tariffs push buyers toward domestic options.

By Brian Martucci • May 5, 2025 -

Policy, tax uncertainty holding back US clean energy development

Clean energy policy experts gathered at DC Climate Week said that the current uncertainty around the U.S. tax and tariff environment is inhibiting the market.

By Lamar Johnson • May 2, 2025 -

Federal appeals court temporarily pauses litigation on Biden-era DOL ESG rule

The U.S. Fifth Circuit Court of Appeals issued a 30-day pause in the case, but noted that it “will not permit an open-ended abeyance.”

By Zoya Mirza • May 1, 2025 -

FASB’s draft rules could harm environmental credit markets: Environmental Defense Fund

The Financial Accounting Standards Board is proposing specific accounting standards for carbon offsets and other climate-related credits and obligations, sparking concern from environmental groups.

By Maura Webber Sadovi • April 30, 2025 -

DC Climate Week opens with calls to innovate approach to sustainability

Over 3,500 attendees have gathered in the nation’s capital this week to talk about innovation in climate tech, boosting green financing and more.

By Lamar Johnson • April 30, 2025 -

Clean energy manufacturers cancel projects as Trump-era policies take hold

Companies canceled, closed or downsized nearly $8 billion in projects in Q1.

By Kate Magill • April 28, 2025 -

More anti-DEI shareholder proposals fail at Goldman Sachs, Levi’s

Proposals aimed at overturning or altering companies’ DEI practices have been unpopular with shareholders. Submissions to the financial institution and clothing company received less than 2% support.

By Lamar Johnson • April 28, 2025 -

NYC pension funds to drop asset managers lacking solid net-zero plans: comptroller

“Our new standards demand that the retirement systems’ managers strengthen their net zero plans consistent with their fiduciary duty — or we will find new asset managers who will,” Brad Lander said.

By Zoya Mirza • April 25, 2025 -

Google signs first offshore wind deal in Asia Pacific region

The deal with Copenhagen Infrastructure Partners adds wind power to the search giant’s renewable energy portfolio in Taiwan, which was recently expanded to include geothermal energy.

By Lamar Johnson • April 24, 2025 -

Mastercard announces solar, geothermal projects for its facilities

The payments company will build a solar panel array to power its tech hub in Missouri and replace its natural gas cooling and heating system with geothermal at its New York HQ.

By Lamar Johnson • April 23, 2025 -

New York state pension fund commits $2.4B to climate-focused investments

The investment is part of the New York State Common Retirement Fund’s broader goal of allocating $40 billion to sustainable investments and climate solutions by 2035.

By Zoya Mirza • April 23, 2025 -

Labor Dept. considers rescinding Biden-era ESG fiduciary rule

The agency asked for a suspension of litigation in the Fifth Circuit Court of Appeals, as it considers whether to get rid of the rule allowing pension funds to consider ESG factors.

By Lamar Johnson • April 22, 2025 -

EPA granted appellate stay after judge rules to end GGRF funding freeze

A judge ruled Tuesday to end the freeze and allow grantees to access their funding, but appellate judges granted EPA a stay on that injunction late Wednesday.

By Diana DiGangi • April 21, 2025 -

Energy regulator grants BlackRock renewed authorization for large utility investments

The Federal Energy Regulatory Commission gave the nation’s largest asset manager approval to continue to acquire up to 20% of voting securities for utility companies for another three years.

By Lamar Johnson • April 18, 2025 -

Trump administration ordered to resume IRA funding

A federal judge’s decision, which stated agencies lacked authority to pause funding, follows the president’s executive order to freeze the money on his first day in office.

By Kate Magill • April 18, 2025